This article provides insights into why 27 Crags deducts withholding tax (WHT) from your topo payments and how it varies across different countries.

What is withholding tax?

Withholding tax is the amount that 27 Crags is required to deduct from the royalties and remit to the government. As our company is registered in Finland, the withholding tax is paid to the Finnish government.

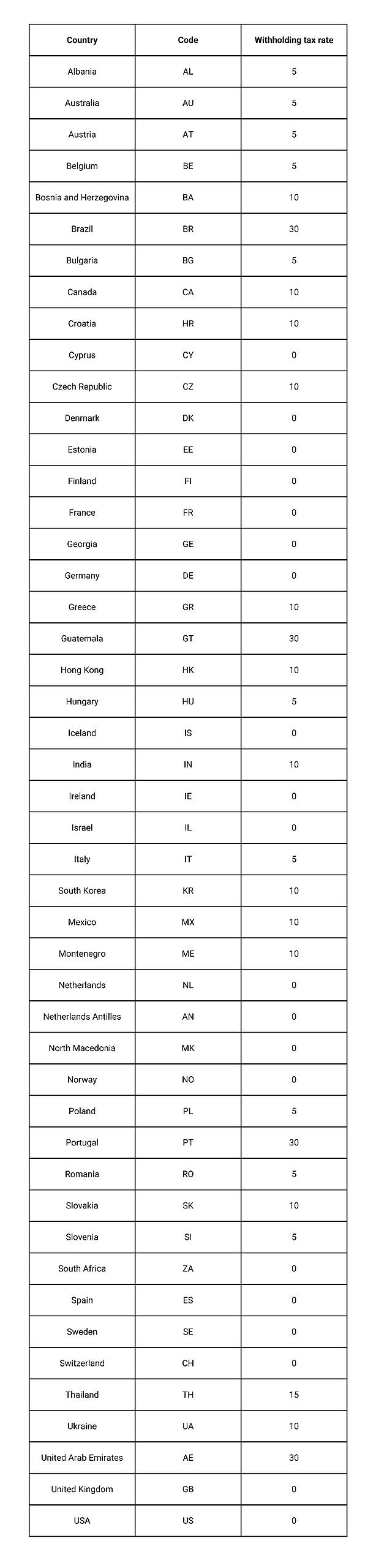

The withholding tax rates vary depending on the agreements Finland has established with individual countries.

You can find the chart detailing the tax percentages for each country at the end of this article.

Understanding 27 Crags payments as topo royalties

At 27 Crags, payments for your topos are considered royalties. As the owner of the topo material, you receive royalties whenever your material is accessed and used by climbers.

To illustrate, this arrangement is similar to how book authors receive compensation based on the sales of their books.

Your responsibilities as a topo author

The withholding tax is automatically deducted from your topo payments before they are disbursed to you. Therefore, you do not need to take any action in this regard.

However, it's important to note that apart from the withholding tax that our company pays, you are also responsible for paying any personal taxes owed on the topo royalties according to the laws and regulations of your country.

Please consult with your local tax authorities or a legal professional if you have any inquiries regarding your personal taxation.